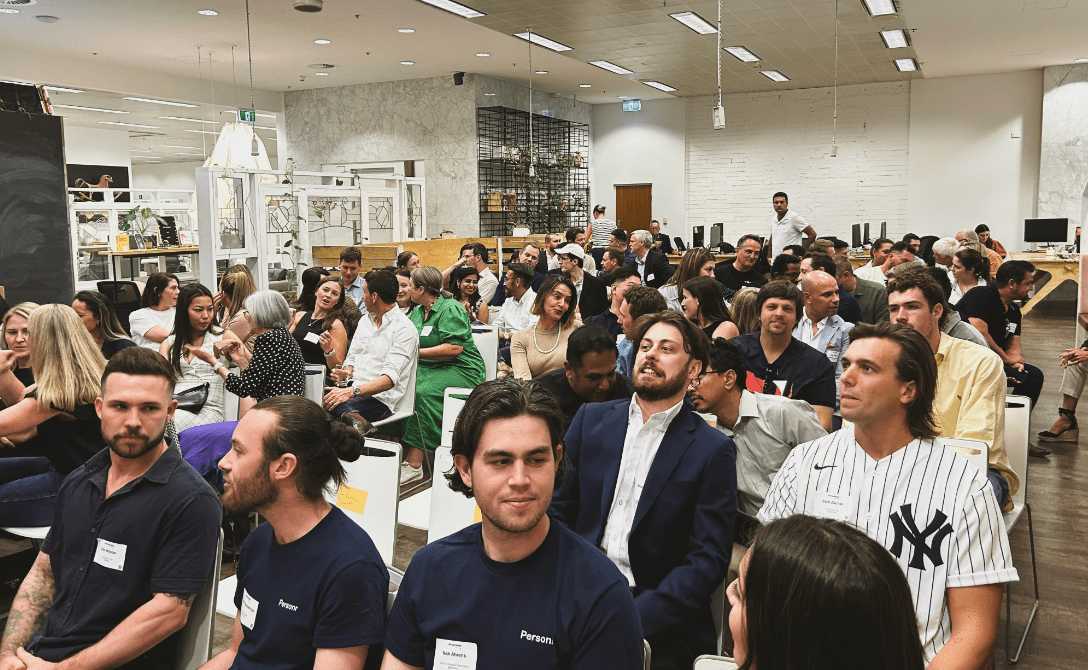

EVENT | Startup&Angels Perth 2023 | 16th November

Tips for Investment Strategies - Insights from Investors

Our Investment Strategies event was a success!

Attendees received valuable insights from investors, including the Scaleup spotlight featuring Douglas Friday from Expede and a panel discussion moderated by Neal Cross. The panel included Jason Balchand, Kylie Gerrard, Tracie Clark, Marcus Ellson, and Wilson Casado, generously shared their knowledge to guide attendees through the investment process.

Gain further insights from the investors’ perspective:

At what stage do you believe it is appropriate for a startup to seek out investors?

The common advice is to begin early because while investors provide funds, they also assist in refining and developing your idea. It’s crucial to make your concept as precise as possible. Establishing an early connection with investors is advantageous, as they may track your progress and potentially invest later on. Initiating contact with investors sooner rather than later ensures that you have a relationship established for the future. Seize opportunities to get to know them.

How can you find an investor?

To start, maintaining communication with the investors you’ve been in contact with since the beginning is key. They have a better understanding of your business and your objectives.

Additionally, reach out to other founders who have successfully raised funds. Ask them questions like, “Where did you secure your funding, and how did you discover it?” Cultivate a sense of curiosity.

Utilizing startup networks, such as Startup&angels, is another effective strategy. Attend events to connect with investors or be introduced to them through the community. Remember, reaching out to multiple investors is crucial; it allows you to select the one that best aligns with your business needs.

However, there are alternative sources of capital such as accelerators, support from family, and friends who believe in your project. The more financial support you can secure, the better. It’s also advantageous to have a diverse mix of capital to broaden your funding sources. It’s worth noting that the most valuable funds for your company often come directly from your clients.

Here's the lowdown on what investors pay attention to when you're approaching them for funding:

The key takeaway highlighted by the panelists is that investors primarily focus on the founders—digging into their background, understanding why they’re passionate about the project, and evaluating how they articulate their ideas.

Keep in mind the 3Cs that investors consider:

- Chemistry: Will there be good vibes, and do you share a similar vision

- Character: Are you genuinely enthusiastic and authentic about your project

- Competency: How well do you comprehend the problem you’re tackling, the market you’re entering, and the associated risks

Furthermore, investors take a close look at the financial side of things. You need to be clear about the amount of money you’re seeking, provide a breakdown of how you’ll use it, and explain the reasons behind each expenditure. Building trust with the investor is crucial in this aspect. So, keep in mind the three primary questions you have to answer to

- Who you are

- How many do you want

- How will you spend it

Finally, note the biggest mistake investors usually see that you have to not make:

Firstly, ensure your pitch is well-structured. Some founders present a pitch where the solution comes first – avoid that. Begin by explaining the problem you’re addressing and then detail how you plan to solve it. Make your pitch deck visually appealing, add colors, incorporate storytelling, and include relevant images. It should be something you take pride in.

Moreover, many founders lack a clear understanding of the market they’re entering. Some believe they have no competition, but it’s essential to recognize that there’s always some form of competition. Conduct thorough market research, provide precise numbers, and be well-versed in your industry.

Ensure that your pitch is easily understandable by everyone. If you’re in a complex field with technical words, simplify your language. Investors should grasp your message, so adapt your communication style accordingly.

Lastly, if you mention in your pitch deck that you’ve secured contracts, make sure you have tangible proof. Some founders claim agreements without having them confirmed. Remember, trust is paramount, and if you don’t have the contracts, investors may doubt your credibility.

THANKS TO OUR SPONSORS

A heartfelt thank you to our sponsors for their faith in us all year round. We would not be able to deliver amazing events and opportunities for our exceptional members without your support.

Share this post